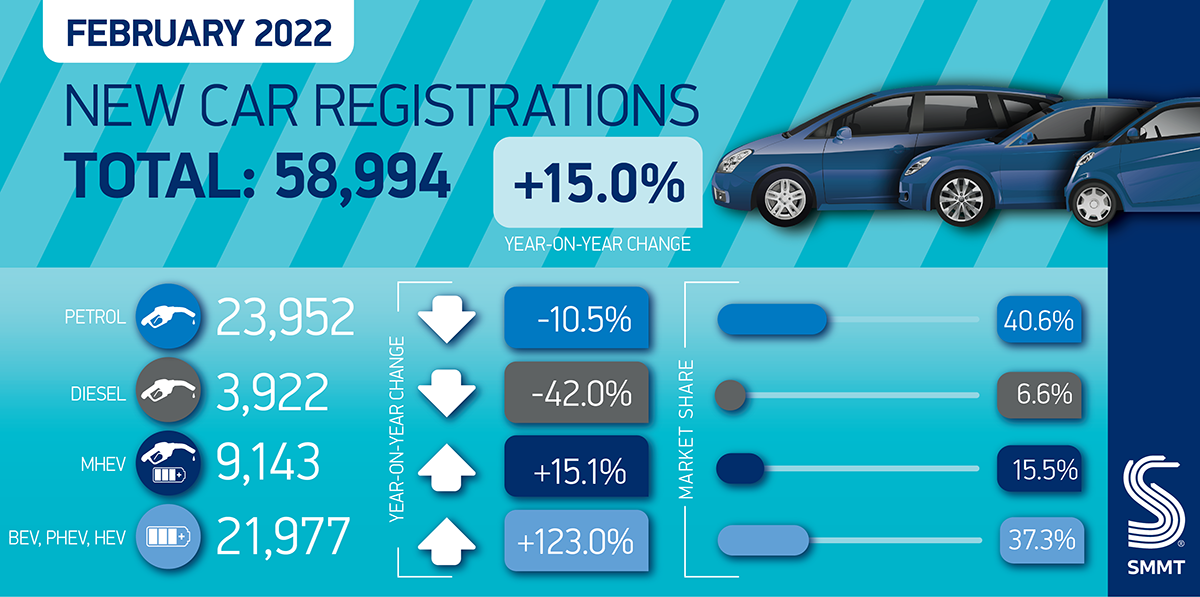

WITH the country reeling from the impact of three disruptive storms, car registrations in February continued a similar pattern to January with sales showing an improvement over 2021 of 15%, but a significant drop of almost 26% from pre-pandemic February 2020.

A rise of 7,682 units was in comparison with the same month in 2021, when the pandemic shut car showrooms across the UK. Despite this positive performance, registrations are down 25.9% on pre-pandemic levels, as vehicle supply remains constrained by semiconductor shortages, according to the latest figures from the SMMT.

Compared with February 2021, when showrooms were closed and only ‘click and collect’ permitted, private registrations rose by 30.0%. Large fleet registrations remained stable, up just 2.0%, indicating that in a supply-constrained market, manufacturers are also prioritising private customers, which accounted for more than 80% of growth. While business purchases grew by 110.7%, this equates to a rise of just 693 units.

It was another good month for battery electric vehicles (BEVs), however, which took a 17.7% market share to reach 10,417 units, while registrations of plug-in hybrids (PHEVs) rose to 4,677 units and a 7.9% share of the market.

When combined with hybrid (HEV) registrations (6,883), electrified vehicles accounted for more than a third of all new cars leaving dealerships. While this demonstrates the growing demand for electric cars, February is typically the lowest volume month, as many buyers delay purchases until the ‘new plate’ month of March, and fluctuations in supply for some key models can have a more pronounced effect in terms of market share.

Meanwhile, April will see the effective end of the Electric Vehicle Homecharge Scheme (EVHS), which has provided vital funding for homeowners to install their own chargepoint. Ahead of the government’s Spring Statement, SMMT is calling for an extension to both the EVHS and its business counterpart, the Workplace Charging Scheme, beyond 2025 to ensure EV uptake remains on track to meet Government’s net zero deadlines.

It also recommends that VAT on electricity used for public charging points be cut to match that for home use, so that EV drivers are treated equally regardless of where they charge their vehicle.

Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), said: “Looking ahead, supply-side constraints are likely to continue to remain a factor, driven by known macro events.

“Notwithstanding that, NFDA will continue to work with members to ensure that they continue to assist their customers with everything from service plans to nearly new and used vehicle sales.

“The majority of franchised dealers are cautiously optimistic about the levels of consumer demand in 2022 despite the impact of external factors and are looking forward to a busy plate change month”.

Manu Varghese, from EY’s UK & Ireland Advanced Manufacturing & Mobility Team, said: “Supply chain impacts and the chip shortage continued – and will continue in the short term – to frustrate the industry. We are in 2021 results season, with many auto manufacturers attributing falling production numbers (UK car production fell 20% in January this year) and high levels of unfulfilled customer orders to the shortage in semi-conductors.

“Despite that, February saw assertive statements from OEMs and automotive suppliers regarding an easing of the crisis. Through a combination of vertical integration and partnerships they have begun to see light at the end of tunnel and manufacturers are expecting a ramp up in production during the second half of 2022.

“Added to this, ongoing geopolitical uncertainties are likely to have an impact on the sector’s manufacturers, supply base, distribution and retail.

“According to latest data released by the SMMT, there were 7.5 million used car sales in 2021, which was an increase of 11.5% to the previous year. To put into context, this was almost five times new car sales of 1.6 million.

“While the increase may come as no surprise to most, an interesting statistic was a 119% increase in sales of used electric cars, which serves as further proof that consumers are ready for a shift to clean energy. Although petrol is set to remain the most popular fuel choice for used car buyers for the next few years, EVs will steadily overtake them over time as drivers opt for cleaner and cheaper plug-in alternatives.”

Varghese added that although March has traditionally been a key month for automotive sales, March 2022 is expected to follow a similar pattern to the last 18 months. Geopolitical uncertainties, inflation and rising fuel prices are expected to result in a poorer performing month compared to pre pandemic times.

However, from a long-term perspective, February had a number of positives for the sector. The UK government announced an end to all COVID restrictions which is very positive news if you are in the business of selling products and services that enable personal mobility. There are tangible signs that the crisis related to the semi-conductor shortage is easing. Also, earnings announcements showed many OEMs & dealers continued to record profits despite the disruption.

“On the EV front, registrations in the UK for cars that run on clean energy continued to surge ahead. And in a positive step for the UK, a Swedish electric car manufacturer announced plans in February to open a new research facility in the Midlands, which is expected to eventually employ more than 800 people. All of the above point to a positive second half for the sector.”

Leave A Comment