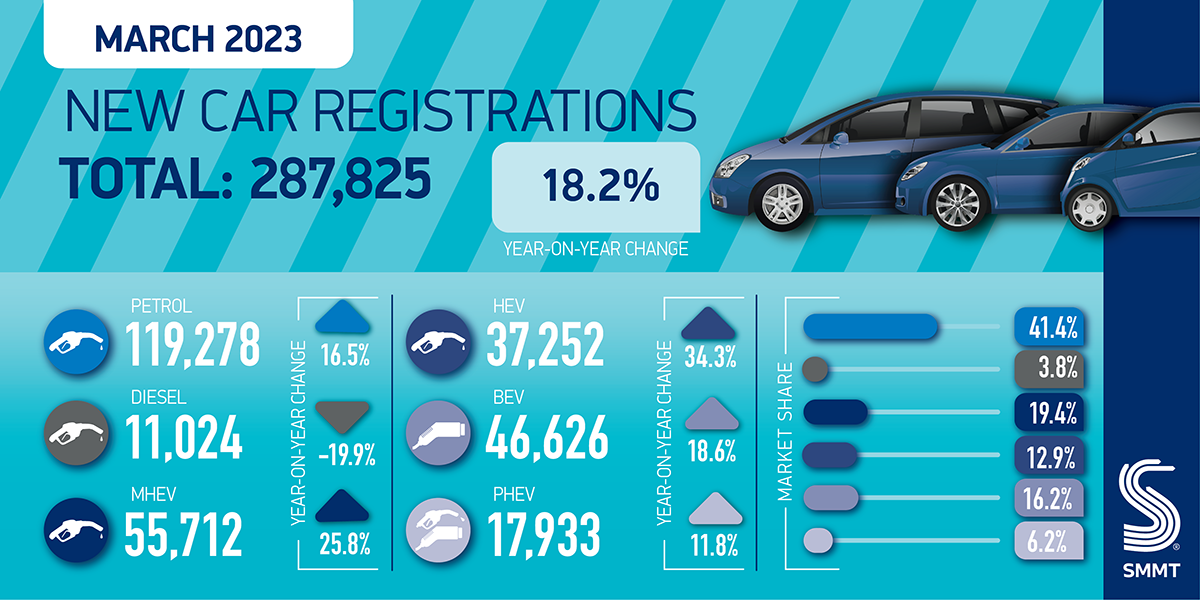

UK new car registrations in March bounced back by 18.2% to deliver the best ‘new plate month’ performance since before the pandemic, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The increase saw 287,825 units delivered, the eighth consecutive month of growth for the new car market, as supply chain challenges slowly continue to ease. As a result, the first quarter of 2023 is the strongest since 2019, with just under half a million new cars joining the road.

This represents an additional £2.7 billion of deliveries, underlining the contribution the sector can make to UK economic growth, despite the market still being significantly below pre-pandemic levels, down 29.5% on Q1 2019.

Registrations rose across all sales types, with deliveries to private buyers up by 1.4%, and those to businesses with fleets of fewer than 25 vehicles up 26.0%. Large fleets, however, were the predominant drivers of March’s growth, with registrations rising by 40,651 units, a 40.9% increase to take an overall 48.6% market share.

By segment, superminis posted the largest percentage growth – up 27.2%, to remain Britain’s most popular car type. Lower medium and dual purpose vehicles were the second and third most popular respectively, with all three vehicle types combined representing 86.5% of total registrations.

Petrol-powered vehicles remained the most popular fuel type, comprising 56.3% of new units, while battery electric vehicle (BEV) deliveries reached a record monthly high of 46,626, representing growth of 18.6%.

Overall, the BEV market share remained almost the same as last year at 16.2% and, with plug-in hybrid (PHEV) registrations growing by 11.8%, plug-in registrations comprised 22.4% of the market – a slight decline on 2022. The biggest growth, however, was in hybrids (HEVs), with a 34.3% surge helping electrified vehicles account for more than one in three registrations for the month.

With the publication last week of the consultation on a Zero Emission Vehicle Mandate – due to come into force in less than nine months – the market will have to move more rapidly to battery electric and other zero tailpipe emission cars and vans.

Models are coming to market in greater numbers, but consumers will only make the switch if they have the confidence they can charge whenever and wherever they need. Success of the mandate, therefore, will be dependent not just on product availability but on infrastructure providers investing in the public charging network across the UK.

Mike Hawes, SMMT Chief Executive, said: “March’s new plate month usually sets the tone for the year so this performance will give the industry and consumers greater confidence. With eight consecutive months of growth, the automotive industry is recovering, bucking wider trends and supporting economic growth.

“The best month ever for zero emission vehicles is reflective of increased consumer choice and improved availability but if EV market ambitions – and regulation – are to be met, infrastructure investment must catch up.”

Lex Autolease Managing Director Nick Williams, said: “The introduction of the new 23 registration plate boosted the number of vehicles coming onto the UK’s roads last month as drivers sought to get behind the wheel of the latest models, and it’s encouraging to see the best month ever for electric vehicle registrations as their share of the new market continues to increase.

“Last week saw the government reaffirm its commitment to the ban on the sale of new petrol and diesel vehicles by 2030 and launch a consultation on the Zero Emissions Vehicle mandate. While it’s yet to be seen if the finalised legislation will fully deliver on aims to boost the supply of electric vehicles in the country and drive investment in the sector, this latest announcement is a bold step forward on the journey to net zero.

“Drivers and businesses alike also welcomed the government’s additional investment of over £380m to develop the UK’s charging infrastructure, which will help drive the much-needed expansion of the network to cater for the growing number of electric vehicles on our roads.”

Mark Oakley, Director of AA Cars, commented: “Today’s buoyant new car market is unrecognisable compared to where it was a year ago, when sales slumped amid a perfect storm of shortages – of both cars for sale and fuel.

“Fuel prices have now settled, the queues of drivers waiting to fill up are a thing of the past and vehicle production lines are mostly back up to speed.

“So much so that separate data from the SMMT shows the number of cars rolling off UK production lines for the domestic market jumped by 20% in February compared to the same month last year.

“With supply back on track, demand is holding up well, and March’s jump in sales extends the new car market’s uninterrupted run of increasing year-on-year registrations to eight straight months.”

John Wilmot, Chief Executive at car leasing comparison website LeaseLoco, added: “With supply chain constraints easing, an eighth consecutive month of growth shows new car sales are moving in the right direction. However, it would be foolhardy to declare the car industry is out of the woods just yet, because current numbers being posted are still well below pre-Covid levels.

“The industry was severely hampered by plunging consumer confidence and poor model availability in 2022, so it’s not a great surprise that we are seeing high growth figures recorded every month this year compared to last.

“A more accurate indicator of where the new car market is right now is comparing March registrations with 2019 levels, a year before Covid struck and showrooms closed, when sales were above 450,000.

“Registrations last month were 37% lower than March 2019. This shows sales haven’t miraculously bounced back and there’s a large gap to close even to reach parity. We could be talking years before the new car market posts those kinds of numbers again.

“Also, supply chain issues may have abated but the car industry is now battling the impact of higher inflation and the cost of living crisis on consumer purchasing power and consumer confidence.

“Future car sales are going to be highly dependent on people buying plug-ins with March figures showing electric and hybrids made up 22% of all new car sales. But if inflation doesn’t start to fall soon, households may baulk at buying a new electric car until it does. And the Government’s energy bill discount ending is bad timing, just when momentum needs to be maintained.

“The fact that diesel and petrol prices have also fallen significantly from their highs last summer, means for many switching to electric may not feel like a decision that needs to be taken immediately.”

Leave A Comment