THE new car market remains incredibly resilient despite the inflationary squeeze on consumer spending, posting 12 straight months of rising sales.

Mark Oakley, Director of AA Cars, said the continued increase in sales mirrors the rebound in UK car production, which has also recorded five successive months of growth. This boost in supply is helping drivers pick up the keys to the newest models much more quickly, and shorter wait times do help sales.

He added: “The first cars with the coveted September registration plates will be appearing on forecourts next month, and dealers will be hoping this provides further momentum to sales.

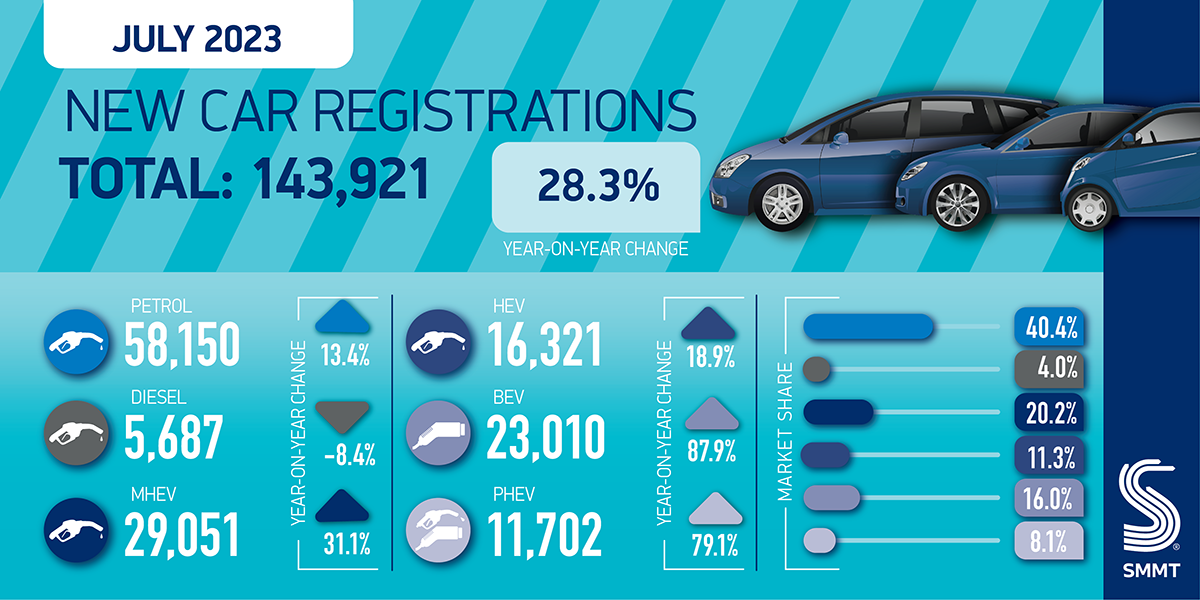

“Meanwhile, EV sales remain significantly higher than last year, up 87.9% compared to 2022, but with the expansion of London’s ULEZ coming into effect later this month, there are still questions over whether this uptake is fast enough.

“With UK production of EVs reaching a record 170,000 units in the first half of the year, supply is rapidly increasing but more needs to be done to accelerate their take-up. Prices for used EVs on the AA Cars website are falling, and this may entice more drivers to consider a second-hand electric vehicle for their next car.”

This was the best July performance since 2020, when pent-up demand for new cars was unleashed following three months of lockdown during the pandemic. Despite this continuous growth, however, the overall market year to date remains behind pre-pandemic levels.

Company registrations drove the growth, as uptake by large fleets increased 61.9% to 80,961 units and business registrations rose 28.7% to 2,915 new vehicles. Private demand remained stable at 60,045 units (up 0.3%).

Electrified vehicles accounted for more than a third (35.4% of the market). Hybrid (HEV) volumes grew, although their overall market share fell to 11.3%. Plug-in hybrid (PHEV) registrations saw a significant uplift for the second month in a row as uptake rose 79.1% to account for 8.1% of the market. The biggest increase, however, was for battery electric vehicles (BEVs), which recorded an 87.9% increase to account for 16.0% of all new registrations for the month, a market share broadly consistent with that seen so far this year.

The demand for battery electric cars was such that a new one was registered every 60 seconds in the month. Furthermore, according to the latest market outlook published today, this will accelerate to one every 50 seconds by the end of the year, and up to one every 40 seconds by the end of 2024.

While the growth in electric vehicles hitting UK roads is significant, it must move even faster if it is to outpace the rest of the market and enable the UK to meet ambitious but necessary environmental targets. To get even more consumers to make the switch, every means of support must be provided, from fiscal incentives to purchase reassurance – and, most obviously, in ensuring drivers have full confidence that they will be able to charge wherever and whenever required, sustainably and affordably.

There were positive signs on this over the last quarter, as a record high of 3,056 new standard public chargers were installed. This was equal to one new charger for every 35 new plug-in vehicles registered, a significant improvement on the same quarter last year, when the ratio was one for every 58 cars.

However, as government, chargepoint operators and the automotive industry all agree, reassuring drivers means building ahead of need. To reach the government’s minimum target of 300,000 chargepoints by 2030, the installation rate must treble to almost 10,000 chargers per quarter, every quarter. This can only be achieved if the obstacles to installation so commonly cited – arcane planning regulations, competing pressures on local authorities and delays to grid connections – are overcome. An overarching strategy, including a chargepoint mandate, is necessary to create the reliable, accessible and affordable charging network consumers deserve.

Mike Hawes, SMMT Chief Executive, said: The industry remains committed to meeting the UK’s zero emission deadlines and continues to make the investments to get us there. Choice and innovation in the market are growing, so it’s encouraging to see more people switching on to the benefits of driving electric.

“With inflation, rising costs of living and a zero emission vehicle mandate that will dictate the market coming next year, however, consumers must be given every possible incentive to buy. Government must pull every lever, therefore, to make buying, running and, especially, charging an EV affordable and practical for every driver in every part of the country.

Rising interest rates

However, in its efforts to dampen inflation, the Bank of England’s move to increase the UK interest rate to 5.25%, which is designed to reduce consumer spending, will be bad news for car sales.

The latest increase will place further pressure on the many consumers who are already feeling the cost of living pinch and means that many more may join them, especially as further rate rises are widely forecast.

The latest rate increase only adds to falling consumer confidence. The long-established GfK Consumer Confidence reflected that; ‘reality bites resilient consumers.’

Motor retailers must contend with a more fragile consumer and the likelihood of higher finance costs. Tara Williams, Chief Revenue Officer at AutoProtect Group, is clear that adapting to the current economic landscape by taking steps to add additional confidence to the car buying experience represents an astute approach.

She said: “Value-added products, such as warranties, paint protection, and GAP, traditionally see increased volumes during economic downturns because they engender reassurance and confidence. In today’s environment, they’re all about supporting the good customer outcomes that the FCA’s Consumer Duty focuses on.”

The extended low-interest, low-inflation period means that the millennial and Gen Z generations, typical users of dealer finance, have never experienced the rapid financial challenges that inflation has created.

Returning to lower interest rates is going to take time to happen. It’s not just consumers for whom the current interest rate scenario is new; for many dealer staff, it is also proving to be an eye-opener. Adapting to this latest ‘new normal’ means thinking differently.

Williams added: “It’s time for dealers to look again at the role value-added products can take in marketing, such as advertising used cars with longer warranties and as a profit centre by promoting the inherent reassurance and cost certainty, matching this to each customer’s individual situation.”

Leave A Comment